*Disclosure: I have owned shares of BH since 2021 and it is one of my largest positions1

Biglari Holdings (BH) is a compounding machine run by a skilled capital allocator who treats shareholders fairly. Many readers familiar with BH might think this first sentence is a joke, but that is exactly why this opportunity exists. While the market has held a negative opinion on BH for a long time, I look at this situation differently. Having a different view from the market is where excess returns can be generated, but it also can be where you get exposed for being an idiot. Time will tell which one of these roads I am on.

In this article, I will go through the claim in my first sentence step by step with some evidence to back it up. Also, I will provide some footnotes at the end of the article to show how I arrive at certain calculations. Viewing the past financials of BH can be confusing, as there have been stock splits, the introduction of a new share class, rights offerings, and some circular ownership. BH is a limited partner in a hedge fund that owns shares of BH. Hopefully the footnotes help clear up some confusion. The data providers I look at get the historical financials of BH wrong due to these complications.2 When I discuss per share figures in this article, I am referring to the Class A shares.

For those who are unfamiliar with BH, here is a quick introduction:

Sardar Biglari started a hedge fund in 2000, and eventually took a large position in a restaurant chain called Steak n Shake. Biglari took control of Steak n Shake at the end of fiscal 2008. He eventually renamed the company Biglari Holdings. Although Steak n Shake was near bankruptcy when he took over, he led a quick turnaround. Biglari used the earnings from Steak n Shake to both acquire whole businesses and to invest in stocks. Today, BH owns a few insurance companies, a few oil companies, Maxim magazine, a restaurant called Western Sizzlin, and Steak n Shake.

Compounding Machine

BH is a compounding machine. A careful review of its track record proves that both assets and earnings have compounded at a nice rate ever since Sardar Biglari took over the company. This is after taking into account all of the pay that Sardar Biglari earned as CEO. There are a few different ways we can judge this performance.

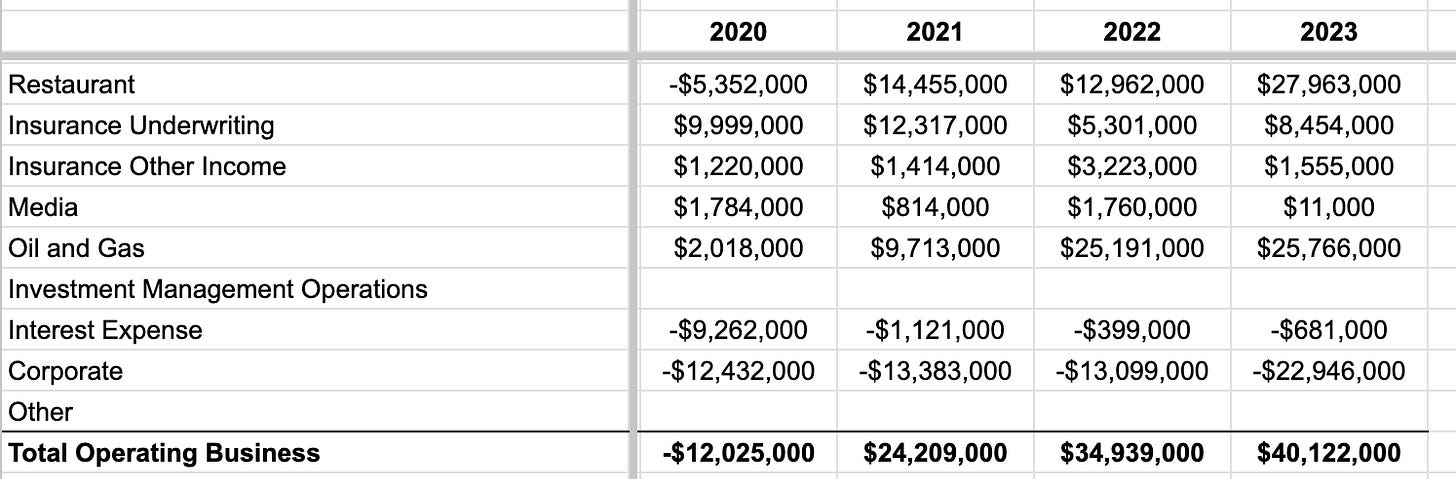

Pretax operating earnings per share (EPS)3, which is all pretax income except for the gains and losses from the investment portfolio, has compounded at about 16% per year since 2009. This is the income from wholly-owned businesses. Sardar Biglari took over at the very end of 2008, but he was taking over a money losing firm that year. Starting with a negative EPS number messes up the compounding calculation, which is why I started with 2009. It is important to remember that Biglari engineered a turnaround when he took over in 2008 right before going on this 14 year compounding journey. He got the business back on track and returned to profitability, and then compounded at 16% per year from this improved base.

If you want to be more conservative, you could expand the scope out a few more years. This is a little unfair because it adds in a few years in which Sardar Biglari wasn’t involved. Fiscal 2007 was a little better for Steak n Shake though, as it earned about $35 per share (on a comparable basis, adjusting for stock splits). From 2007 to 2023, BH still compounded its pretax EPS by over 9% per year.4 Keep in mind that the firm has allocated quite a bit of cash to its investment portfolio during this time period. It didn’t reinvest all its earnings back into its operating businesses, making the increase in EPS even more impressive. If you completely ignore the major investment portfolio of BH, then the company is current valued at less than 7 times the pretax operating earnings of its wholly owned businesses.

BH was able to compound its assets over this time period as well. Book value per share has compounded by 8% per year since 2008. This might not seem impressive at first glance, especially compared to the 16% compound annual growth of EPS. One reason for the lower growth of book value is due to the fact that BH has repurchased a major amount of its own stock5. Your book value goes down when you buy back stock, as your cash is reduced on the asset side while a negative value is created on the equity side as treasury stock. Hundreds of millions of dollars have been allocated towards share repurchases, while I consider the total valuation of BH to be just $281 million today.

Even though this compound growth is nice, it is not just about the overall rate of growth alone. BH has compounded at a high rate while also improving the quality of the corporation at the same time. Sardar Biglari started with just Steak n Shake in 2008, and it had $4 per share of cash against $63 per share of debt. Today, BH has $1,121 per share of investments on the balance sheet with no debt. The firm now owns an excellent insurance business, as well as impressive oil and gas operations. The businesses are of higher quality, the liquidity is extremely high, and BH is far more diversified.

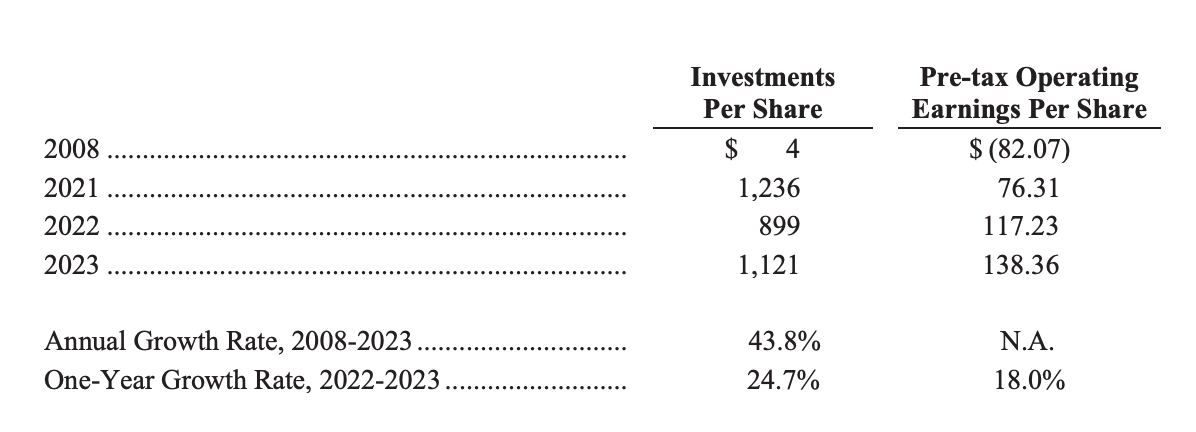

The table below gives another angle to view the changes that took place at BH. It is from Sardar Biglari’s Letter to Shareholders, and it separates the investment portfolio from its wholly-owned subsidiary businesses. Investments per share at BH have compounded at a rate of 43.8% since 2008, while pretax operating EPS has gone from a loss of $82.07 per share to $138.36 per share. This is based on the Class A shares.6

While this is impressive, it is important to note that the growth in investments per share isn’t the rate of return for the portfolio. Money was added to the investment portfolio over time as their subsidiaries generated free cash flow. Still, it is impressive to grow your EPS while also throwing off cash that you can invest elsewhere.

The past performance of the actual company has been great, but what matters is the future. I believe the structure of BH gives it a chance to continue being a compounding machine going forward. The decentralized holding company structure of BH, along with a 46 year old skilled capital allocator at the helm, allows for a nice set up. A 46 year old CEO almost seems like an adolescent when you see Warren Buffett still going strong and working at the age of 93. BH isn’t tied to just one business or industry, and can acquire whole businesses or buy pieces of them in the stock market. The company should be able to continue retaining earnings for many years and find something intelligent to do with that capital. This is how compounding is achieved over a long period of time.

A Skilled Capital Allocator

The leader of BH, Sardar Biglari, is a skilled capital allocator. His resume makes this clear. He has managed a hedge fund since 2000 called The Lion Fund. I don’t know exactly what his returns are in the fund up to the present moment, but I do know that he compounded at a rate of 16% per year for his first 15 years in the fund. This far outperformed the S&P 500 over that period. 15 years is a long time to outperform. The 2016 proxy statement showed that the portfolio inside of BH compounded by 26% per year from 2009 to 2016. The S&P 500 earned just 14% per year over this period. Since then, The Lion Fund has mostly owned BH stock, which hasn’t done well. I’ll address the stock price performance of BH soon, but he had high returns before BH and he has been able to compound the earnings and assets of the company since taking over as well. Sardar Biglari can’t control the stock price of BH, but he has been able to create a ton of value inside the actual business.

The other evidence of skillful capital allocation is in how Biglari recreated Steak n Shake into what BH is today. As I mentioned before, he started with just Steak n Shake alone, with $4 per share of cash against $63 per share of debt. Today, BH has $1,121 per share of investments on the balance sheet with no debt, all while spending money on acquisitions and reinvesting in subsidiaries along the way. The firm now owns an excellent insurance business, as well as impressive oil and gas operations.

Just look at this record that the insurance operation of BH has put together. This is just incredible performance. Most of this is the result of First Guard Insurance Company, which is an excellent insurer. BH also owns Southern Pioneer Property & Casualty Insurance Company, which looks to be a decent insurer as well. The insurance segment has reported profitable underwriting every single year, without taking into account any investment gains. First Guard has never had an underwriting loss in its history, even before being acquired by BH. This is not the normal result in the insurance industry.

BH entered the oil industry in recent years, and this has also been an excellent move so far. BH acquired Southern Oil in 2019 for $51.5 million. Since then, Southern Oil has paid $75.8 million to BH. This is actual free cash sent to the parent company to be reinvested elsewhere. BH acquired 90% of Abraxas Petroleum in 2022, and bought the other 10% in 2023. BH paid $85.4 million, and since that time Abraxas has paid BH $52.8 million. In total, BH paid $136.9 million for these two businesses, while the subsidiaries basically have sent $128.6 million of free cash flow back to the parent company.

BH has been scooping up some bargains lately in the oil and gas space. Why is the company able to find opportunities like this? Competition is declining in this industry. Less firms want to own oil companies. This makes it easier to find deals, but it also makes it a better business environment due to less supply. In the case of Abraxas Petroleum, there was a self imposed forced seller who no longer wanted to be involved with fossil fuels. I assume the sellers are comfortable being customers of an oil company, but no longer wanted to have ownership over an oil business. BH acted quickly to help them exit that industry.

Importantly, I admire the capital allocation strategy at BH within their oil subsidiaries. They have been avoiding oil exploration. Instead, they have been partnering with others who are willing to put up that risk capital. BH doesn't feel the need to find new oil wells to replace what is being depleted. Since money is fungible at BH and each dollar of capital can be invested in any type of industry or asset class, the company will only pour more cash into a business when there is potential for attractive returns.

Shareholders Treated Fairly

Although I would argue that shareholders aren’t treated in an optimal way, Sardar Biglari does treat shareholders fairly. There is a difference. I would do some things differently, but this is irrelevant because I am not in charge. Check out the proxy statement of Berkshire Hathaway if you want to see an optimal structure that I would like to imitate. Sardar Biglari controls over 70% of the voting interest of the stock, so he is the one calling the shots here. My job is to identify the reality of the situation at BH, and try to compare it against all other investment alternatives in the world today.

Sardar Biglari is paid a base salary of $900,000 per year. On top of this, there is a service agreement where ‘Biglari Entities’ receive payment for “certain business services to the Company, including related personnel, related legal, related proxy contest, related travel, and other related administrative expenses.” In 2023, this service agreement totaled $8.5 million. In the proxy, this is disclosed as a reimbursement of costs. Just to be safe, I treat this just like it was a salary paid to Sardar Biglari. On one hand, this is conservative as I am sure legal costs and administrative expenses are real. On the other hand, I wouldn’t be surprised if private jets were used in the related travel costs here. I don’t know for sure, but this could include travel to beautiful places like Saint-Tropez in the French Riviera. With that being said, I just assume this is $8.5 million of compensation to Sardar Biglari.

There is more - and I think this is where investors lose interest in BH. Bear with me here. Sardar Biglari has the potential to earn an incentive fee based on the results of wholly-owned subsidiaries, as well as fees based on the results of the investment portfolio. Both of these incentive plans operate in a similar fashion. Biglari earns no incentive fee unless the return exceeds 6%. He then receives 25% of anything above the 6% hurdle rate, with a high water mark (meaning losses need to be recovered first before any payments are made). For the incentive fee on the wholly-owned subsidiaries, the hurdle rate is a 6% growth in book value per year. The investment portfolio needs to gain $162.3 million to get back above its high water mark, so Biglari probably isn’t earning any fees on this portfolio in the near future. Plenty of investment managers (including me) use this fee structure, but it is unique to find this fee structure within a corporation.

In a way, this just feels excessive. Sardar Biglari is earning money multiple different ways here. It seems unnecessary since he controls around 70% of the company. As I mentioned earlier, this is fair but not optimal. It is fair because it is based on results. Remember, BH’s 16% annual growth rate of EPS is after all of these payments to Sardar Biglari were made. BH has still compounded at a nice rate despite this pay structure, which is why I consider it fair. Why isn’t it optimal? Consider a company like Costco. Their mission is to provide members with quality goods and services at the lowest possible prices. Costco operates with very low margins. Costco could probably raise their prices a little bit and still keep their customers happy. They would still probably be cheaper than some of their competitors. It might be fair for Costco to earn a slightly higher margin, but it wouldn’t be optimal. Customers trust that Costco will offer the lowest possible price. Many customers don’t even bother to compare prices with the competition to verify that is actually the case. Costco has earned this trust over the decades. If Costco temporarily raised prices, customers might not notice or care. Eventually, customer trust would be eroded even if it is just a slight change. This could leave room for competition to come in and offer customers better deals.

Costco’s strategy has been described as “scale economies shared”. As Costco grows, it has economies of scale through bargaining power with suppliers or through more efficient operations. Costco then shares those economies of scale with customers by lowering prices. I think there is an analogy here with how shareholders are treated at Berkshire Hathaway. Warren Buffett is only paid a salary of $100,000. Of course it would’ve been fair for him to have been paid more over the decades. It wasn’t a fair compensation scheme for Buffett, but it was optimal for Berkshire. Profits were shared equitably with all shareholders. This created a flywheel of its own at Berkshire. The stock price performed better due to this, which attracted more shareholders and more attention. Those new shareholders were treated extraordinarily well, which attracted more shareholders and more attention. There is a limit to this though, as Berkshire never had a wildly high valuation, but the company does benefit from a loyal base of shareholders. The positive image and the large amount of attention helped them make more acquisitions over the years as well. I believe BH could benefit from being operated in a more optimal way, but I do feel like I am treated fairly as a shareholder. A long time shareholder could complain about the stock price, but not about the results of the underlying business. Sardar Biglari has not been granted stock options, and he’s never sold a single share of BH. He benefits more from the stock price than from any compensation scheme in place at BH, and this is a strong incentive.

There have been promising signs in this area as well. Sardar Biglari has cut back on pay at times. He changed the rules to get paid less in some cases. For example, BH invested more money into Biglari’s hedge fund in 2020 and earned a profit in excess of the hurdle rate. Under the rules at the time, Sardar Biglari earned fees off this new money invested during 2020. However, he recommended that the Board amend the partnership agreement so that he wouldn’t earn these type of fees until all past losses were recovered. He hasn’t earned an incentive fee in years from the investment portfolio.

There was a rule in place at BH in the past that was pretty extreme. If Sardar Biglari lost control of BH, he was set to receive a royalty of 2.5% of revenue in exchange for him licensing the use of the ‘Biglari’ and ‘Biglari Holdings’ names. I don’t know if that would have held up in court, but the rule is no longer in place. Sardar Biglari never received any money from this royalty. I believe it was just a tactic he used in order to ensure he had control of BH. This doesn’t bother me due to the fact that no money was paid, and because I believe no money was ever expected to be paid. Since I am not in control, I want the person who is in control to make it their life’s work. This is Sardar Biglari’s passion and mission. I expect someone like this to desire full control over their work. Although the royalty arrangement was a red flag, Sardar Biglari’s grip on BH is tight enough where the case is closed on the topic of control. I don’t expect any issues like this to pop up in the future due to the question of control being settled.

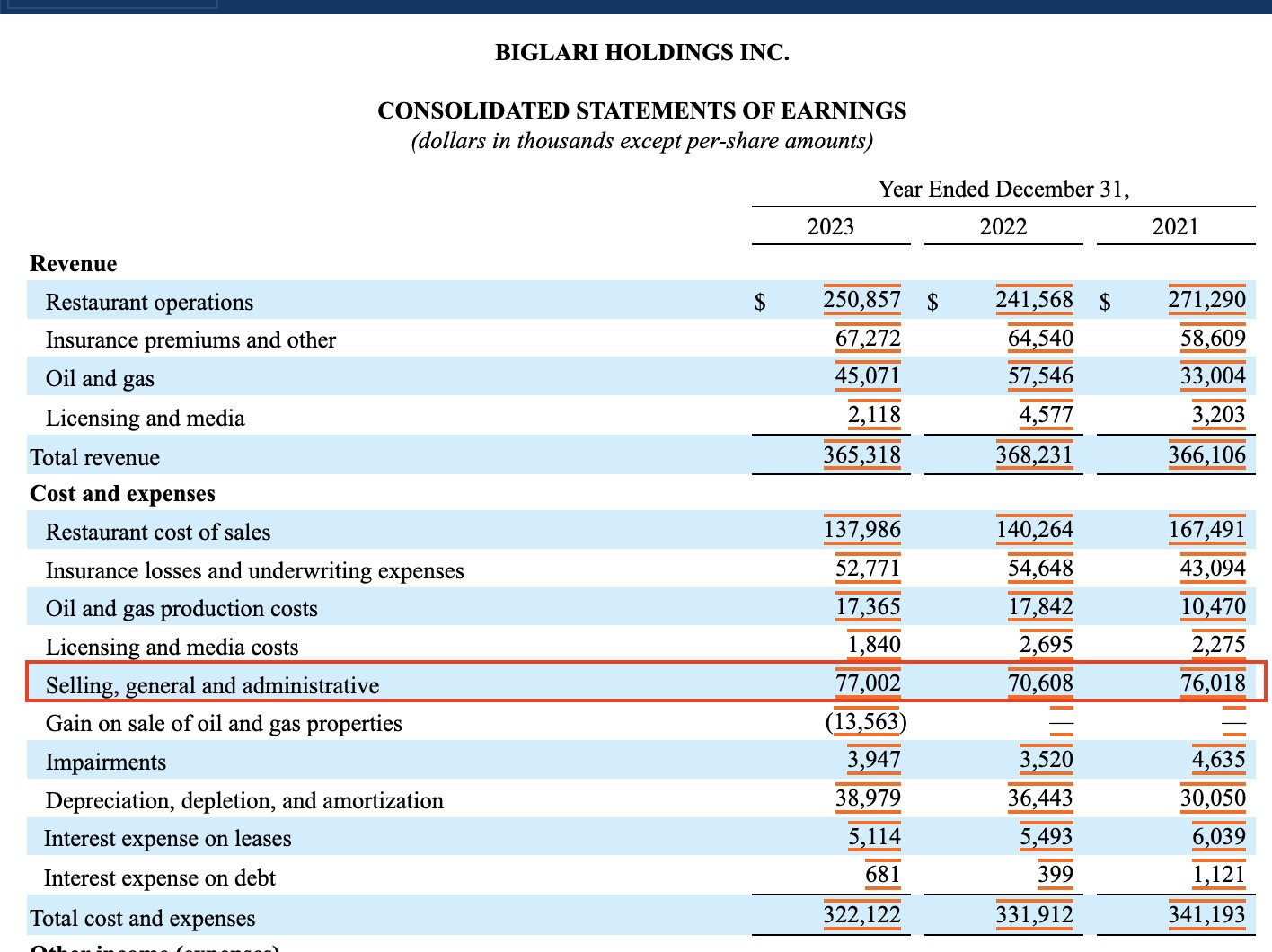

Finally, one thing is clear - BH is run in an extremely efficient manner. This is a low cost operation, even after factoring in the pay for the CEO. Just compare the company before Sardar Biglari took over until now. Selling, general, and administrative costs amounted to $77 million in 2023. This includes marketing expenses. In 2008, SG&A costs totaled $79.1 million. Back in 2008, the company was just Steak n Shake. Today, BH still owns Steak n Shake and has all of the SG&A costs of that business, combined with multiple insurance companies, oil companies, Maxim magazine, and another restaurant chain. BH also manages a large investment portfolio. Despite the growth in the scale of operations, as well as the inflation that has occurred since 2008, BH has lower SG&A costs today than it had in 2008 even after factoring in all of the CEO’s pay. This is an efficient, low cost operation. All else equal, I would argue that an efficient operation that pays its CEO millions of dollars is more valuable than an efficient operation that pays its CEO nothing. It is hard to reduce the pay of a CEO to below zero, while you could still operate BH while paying its CEO less, assuming Sardar Biglari would agree to that.

Valuation

Now, let’s move on to the mouth watering valuation. This is a company that is cheap based on both earnings and assets. It is selling below liquidation value. The company has grown at a nice pace in the past, and I expect it to continue compounding in the future. The stock price performed poorly in the past, but any multiple expansion in the valuation could be a major tailwind for the company. The discount can act as a form of leverage.

Based on the Class A shares of stock, BH has $1,121 of investments per share against a stock price of $968 per share. Even though the company owns valuable operating businesses as subsidiaries, BH is trading below the value of its portfolio of stocks alone. BH has a book value of $2,105 per share, so the company is selling for 46% of book value. Pretax operating earnings per share amounted to $138 in 2023, so even if you ignore all of their cash and investments, BH is trading for less than 7 times pretax earnings of wholly-owned businesses.

This situation made me think back to the early days of Berkshire Hathaway. The stock price of Berkshire compounded at a rate of 29.2% from 1962 to 1985. Where exactly did the returns of Berkshire come from? The book value of Berkshire compounded at 19.3% per year over this time period. When Warren Buffett first invested, Berkshire was trading for 37% of book value. By 1985, Berkshire’s valuation was up to 166% of book value. I calculate that this multiple expansion added returns of 6.7% per year over this 23 year period. Share repurchases can probably account for the 3.2% of returns that are leftover. Basically, Buffett was able to leverage discounted capital, and turn it into equity capital that was fully valued. I am not saying that Biglari Holdings will match the results of Berkshire. I only use this example to illustrate how a low valuation can be a form of leverage if multiple expansion ever occurs. As the case with Berkshire showed, the leverage can be meaningful.

Stock Price Performance

When reviewing the history of BH, the first red flag that you could point to would be the stock price performance. The stock price is almost unchanged since 2018 when the Class A shares were introduced. The stock price also hasn’t been very impressive since Sardar Biglari took over, underperforming the S&P 500 in what is approaching a 16 year time period. I aim to be a long term investor, but 16 years is a long time.

Why has the stock price suffered despite the nice performance of the underlying financials? To be clear, I don’t really know. That won’t stop me from speculating though. One minor reason could be that the historical financials are a little confusing, and not enough investors have investigated the firm. Data providers often get the financials wrong for BH. There have been stock splits, the introduction of a new share class, rights offerings, and some circular ownership. This is a relatively small company with most of its shares held by longtime shareholders. The major reason though could be the image of Sardar Biglari in the market.

I believe investors worry that Sardar Biglari is a wolf in sheep’s clothing. He clearly modeled himself and his company so much after Berkshire Hathaway, yet there are some clear differences. The two companies have the same initials. Both are decentralized holding companies. Sardar Biglari and Warren Buffett even share the same birthday (August 30th). Sardar Biglari puts out his shareholder letter the same day that Buffett does. Both companies hold annual meetings where they are willing to speak on stage to investors for hours. This next point is nerdy, but I’m going to go with it anyway. When corporations file financials with the SEC, a Central Index Key (CIK) is used on the SEC's computer systems to identify those corporations. It is common for companies to change CIK’s after a large merger or other major corporate event. The historical filings for Berkshire before 1999 show up as OBH LLC, which I assume stands for ‘Old Berkshire Hathaway’. The filings for Biglari Holdings before 2018 show up as OBH Inc. My point is that Biglari Holdings attempts to copy Berkshire just about any chance it gets.

Warren Buffett is a great role model, so why would anyone get upset with this imitation? Well, apparently Sardar Biglari also drives a Ferrari, and enjoys spending time on a yacht in France’s Port of Saint-Tropez. As I mentioned earlier, he also pays himself far more than the salary Buffett receives from Berkshire. Now there is nothing inherently wrong with Ferrari’s or nice vacations, but I think a red flag is raised with investors when they see someone talking like Buffett while living a flashier lifestyle. It is wise to be cautious in a situation like this. Once you take the time to study the long term results of the underlying business at BH, it is clear that Sardar Biglari is creating value for all shareholders.

Although Biglari Holdings does operate in a decentralized fashion like Berkshire, Sardar Biglari has been active in some of their operations. There are signs that say ‘Steak n Shake by Biglari’, and he also named himself the Managing Editor of Maxim. Both of these businesses are wholly owned subsidiaries of Biglari Holdings. You can find pictures of Sardar Biglari hanging on the wall at Steak n Shake locations. You don’t see this type of activity at Berkshire.

At the end of the day, I am a happy shareholder of BH. Sardar Biglari obviously admires Berkshire and has learned a lot from Buffett, but he mixes in his own personality within BH. That makes a lot of sense to me. You can have heroes and can learn valuable lessons from others, but you still have to be true to your own personality. The performance of the underlying business has been great at BH, the valuation is rock bottom, and I am a fan of the CEO. I would do things differently if I were in charge, but I can understand and accept the way things are done at BH.

That’s about all I have to say about that. If you made it this far in the article, go buy yourself a milkshake at your local Steak n Shake. You deserve it.

Footnotes:

This newsletter has been prepared for informational and educational purposes only, and solely represents our views with respect to certain securities, markets, and other financial matters. It should not be used as the sole basis of any investment or financial decision, and should be construed to render any legal, tax, or other professional advice. The statements made herein are solely based on our research, and any forward-looking statements should not be construed to guarantee any particular outcome. All investment strategies involve risk, including our strategy of seeking out a concentration of undervalued companies in the pursuit of potential long-term appreciation. Past performance of an investment is no indication of its future returns, we make no guarantees whatsoever about any future investment returns.

Investment advisory services offered by McDonough Investments, LLC, an investment adviser principally registered in the State of Michigan and registered or exempt from registration in other jurisdictions as applicable.

When data providers are calculating the market capitalization of a company, I believe the shares outstanding from the very beginning of the 10-K are used. Below are the shares that are disclosed for BH:

The problem is that treasury stock is a meaningful part of the balance sheet. BH had equity capital of $599 million at the end of 2023, while treasury stock is reported as $416 million on the balance sheet.

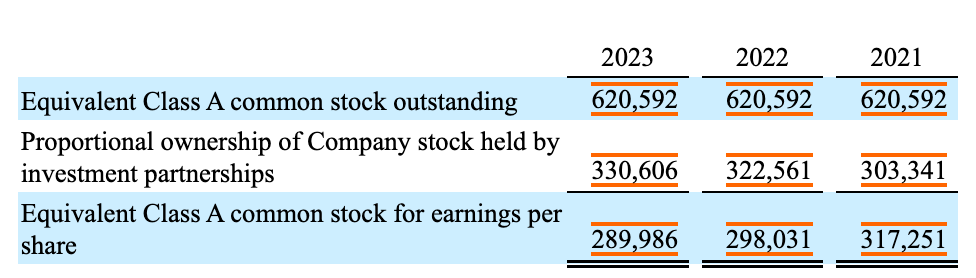

If you divide the Class B shares by 5 and add that figure to the Class A shares, you arrive at the equivalent Class A common stock outstanding. This amounts to 620,592 equivalent Class A common stock outstanding. However, there is treasury stock due to share repurchases. When factoring this in, the shares outstanding is more than cut in half.

Why the confusion? When any other company buys back stock, the shares outstanding at the top of the 10-K reflect this. The situation is different at BH because the company didn’t physically buy back its stock. Sardar Biglari’s hedge fund bought it. In reality, I view this as a share buy back for BH though. If you invest $1 million in a fund, that million dollars belongs to you. Someone else is just stewarding it temporarily. Someday, I predict The Lion Fund will distribute shares back to BH, and at that time the 10-K would reflect the situation as a a normal share buy back.

Yahoo Finance, for example, lists the market capitalization of BH as $593 million. I calculate the market capitalization to be $281 million. Yahoo Finance lists a price to book value of 1.00, while I calculate it to be 0.46. There is a major difference here.

The 10-K of Biglari Holdings discloses the pretax earnings of each wholly-owned subsidiary. Since the EPS figure excludes the investment portfolio, the insurance income only includes underwriting gains as well as ‘other income’. Investment income is ignored. The pretax operating earnings for BH amounted to $40.1 million in 2023.

The share figure used in the EPS calculation is 289,986 equivalent Class A shares, as shown below. Biglari Holdings is an investor in Sardar Biglari’s hedge fund. His fund owns shares of Biglari Holdings. There is some circular ownership here. If the fund is ever shut down, BH would get its share of the fund. In that case, the shares would be treated like treasury stock. Effectively, Biglari Holdings owns those investments and has basically bought back its own shares through the hedge fund. Many data providers ignore these treasury shares in figuring out the shares outstanding.

Steak n Shake earned $14.9 million pretax in 2008. As Sardar Biglari points out in his 2023 Shareholder Letter, adjusting for all stock splits the comparable shares figure before he took over would have been 424,325. The shares outstanding were about the same in 2007. This leads to a pretax EPS of $35 per share.

Divide the Class A per share figures by 5 in order to get the equivalent Class B per share figures