Beenos (3328.JP) is currently my largest holding, and it’s a company I’ve written about in the past. Beenos is an entrepreneurial company with a low valuation. Although these alone are nice features, over time I have been appreciating one of its subsidiaries more and more. This wholly owned subsidiary is called Buyee. I’ve also been impressed with the culture of Beenos.

I’m not going to write about how Beenos has ¥5.5 billion in net cash, along with a ¥21.7 billion venture capital investment portfolio when the valuation of the entire company is just ¥17.5 billion. I’m not going to write about how the valuation looks a little cheap based on earning power alone, even if the venture capital portfolio turned out to be worthless. Instead, I want to drill down on Buyee, as well as the entrepreneurial culture of Beenos overall.

In my last article, I focused on Buyee as a middleman, and investigated the reasons why that can be a surprisingly good type of business. In this article, I am going to focus on Beenos as a spawner of new businesses.

The Spawner Framework

A good entrepreneur is a arbitrageur, finding a gap in the market where there is unmet consumer demand. Mohnish Pabrai’s book The Dhando Investor first opened my eyes to this point. In my last article, I discussed how this is exactly what Buyee has done. Yahoo Japan scaled back its international offerings, while certain products for sale on eBay wouldn’t ship abroad. Small, local retailers struggled to navigate cross border online transactions. Buyee stepped up to fill these gaps in the market. In addition to this arbitrage idea, Pabrai also introduced me to the idea of a “spawner” through his lecture below at Peking University. A spawner is an entrepreneurial company that can create new businesses internally from scratch.

Lately, I’ve been wondering if being a spawner is one of the only true moats remaining. Capitalism is brutal, and just about every company dies eventually due to competition. This is great for individual consumers, but tough for existing companies looking to maintain the status quo. To be confident in your ability to survive as a company over the very long term, you must be able to adapt.

The Buffalo Evening News is one example that comes to mind. The business had what appeared to be an impenetrable moat. Berkshire Hathaway purchased the newspaper in 1977 for around $35 million, and it eventually looked like a home run. The paper dominated the Buffalo market, and in 1985 alone it was earning $30 million pretax. If I was sitting there in 1985, I would have said the newspaper was going to forever continue spitting out more and more profits each year. The situation completely changed over the next decade. Cable television managed to take some advertising revenue away from newspapers, and then the internet came along and shook everything up.

While the Buffalo Evening News wasn’t a spawner, luckily for shareholders, in a way Berkshire Hathaway was. Most of their growth came through acquisitions, but they also internally grew their insurance operation thanks to Ajit Jain. Berkshire was able to adapt and change over time. One business could die while the overall corporation prospered.

Another example could be Sears, Roebuck and Co. The company started out as a mail order catalog and eventually morphed into a brick and mortar retailer. The firm was one of the most dominant corporations in the world at one point in time. At the end of fiscal 1972, Sears operated 837 stores and had equity capital of $4.5 billion. The firm earned profits of $622 million on sales of almost $11 billion. The company enjoyed 18 straight years of sales growth, and was consistently profitable over that time frame. After failing to respond to the competition from numerous retailers such as Walmart, Costco, and later Amazon, Sears eventually filed for bankruptcy in 2018. You might think that shareholders were left with nothing despite the incredible wealth the company created at one point in time. This is actually not the case for shareholders who held onto what was spun off to them over the years. Sears created a company called Allstate in 1931, and held onto the business as a subsidiary for many decades. Allstate was spun off as a separate entity in 1993, so Sears shareholders were able to maintain their proportional ownership in the insurer. Allstate is in the top 100 companies in the US based on revenue, and one of the largest insurance companies in America. Sears also created the Discover Card in 1985. Discover was also spun off to shareholders, and went through some mergers over the years. By 2007, Discover Financial Services became an independent company again. Discover is worth $27 billion today, and Allstate is worth $39 billion. Although the retail business of Sears eventually failed, quite a bit of value was created for shareholders through spawning, and that value remains to this day.

Besides Allstate and Discover Card, there were other ways that Sears created value through its entrepreneurial culture over the years. The company formed Homart in 1959, which built and developed shopping malls throughout the country. This was during a time period in which retail outlets were transitioning from downtown locations to shopping malls. The company was able to build out these malls with the knowledge that Sears would be a key tenant. The firm was one of the largest developers of malls in the US at one point in time. Eventually, Homart was sold to General Growth Properties in 1993 for almost $2 billion. Sears also created valuable brands over the years including Craftsman, DieHard, and Kenmore. These three brands were eventually sold off for over a billion dollars. In recent years, Sears spun off another real estate operation called Seritage Growth Properties. Sears created quite a bit of value outside its main area of expertise.

Just think about the story of Amazon. If you invested in Amazon when it was a new business, you owned a retailer of books. Eventually you owned a retailer of everything, not to mention you also owned a cloud computing platform through Amazon Web Services (AWS). It would have been impossible to predict AWS when Amazon was first starting out. Amazon had plenty of failed businesses along the way. This was a good sign, as its culture allowed for experimentation.

Beenos

Beenos was founded in 1999 as an ecommerce business located in Tokyo. The firm used to be called netprice.com, and was an online group buying service. People could join together to buy products in bulk over the internet in an effort to save money. Although the company began as just Netprice, it eventually expanded as many different businesses were created internally. The firm made a few acquisitions as well.

The company started Shop Airlines in 2007, which operates a site called Sekaimon that helps Japanese consumers buy products from other countries over the internet. They created Tenso the following year, which was the reverse of Shop Airlines. Tenso helps customers from outside Japan purchase products online from Japanese companies. Tenso focused on Japanese ecommerce companies that didn’t ship items overseas, providing international delivery services for consumers and an additional sales channel for third party ecommerce sites. Beenos created a new business called Buyee near the end of 2012. Buyee was the subject of my previous article. Buyee is similar to Tenso, except that customers buy products directly off Buyee’s own website. Tenso customers shop on third party websites.

This story shows the experimentation and adaptability of Beenos. Buyee was the company’s third pivot into a service for supporting cross border ecommerce. Buyee has seen real success, while some experiments proved to be less successful. The company keeps rolling the dice.

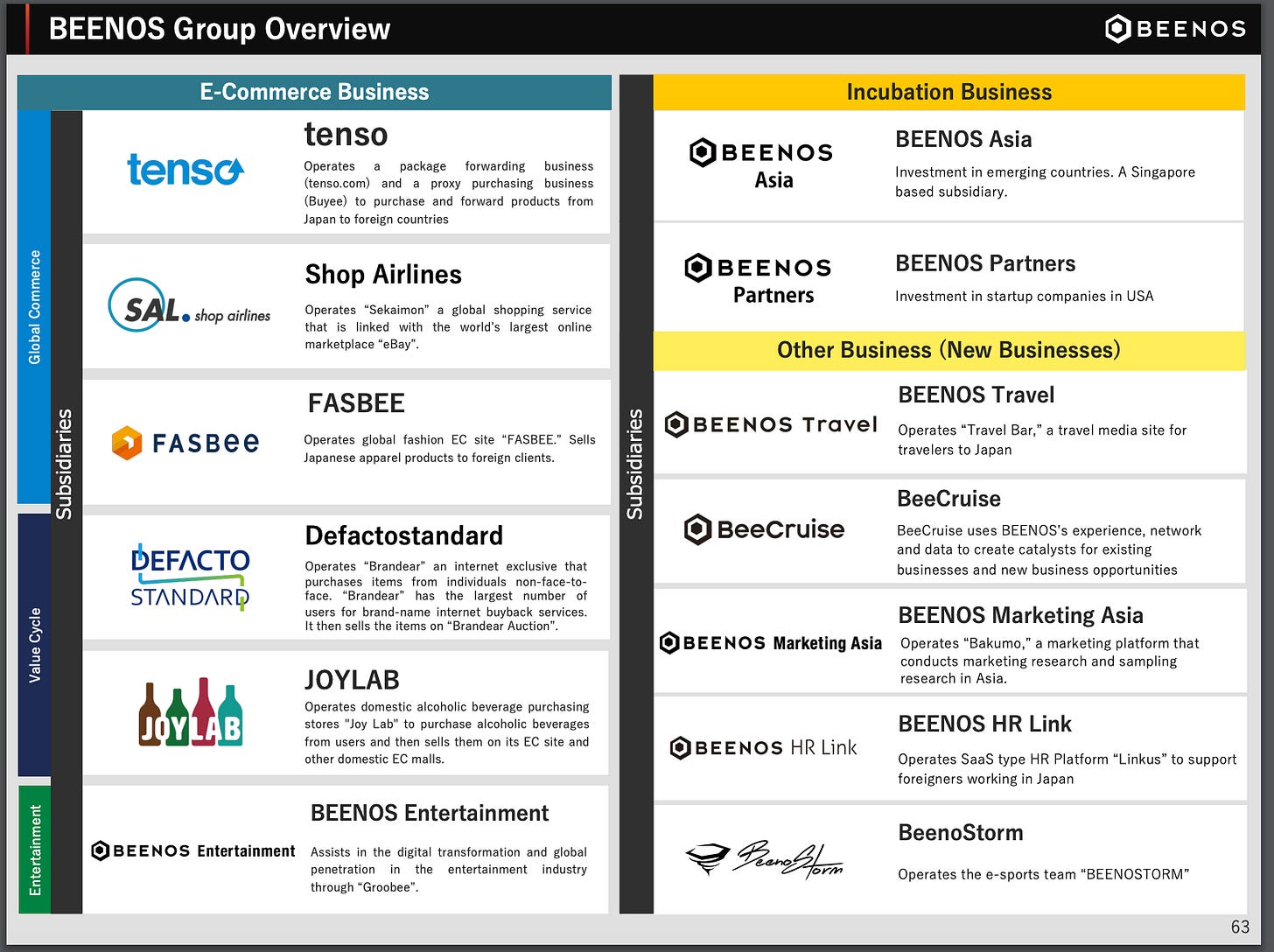

The picture below gives a breakdown of the business segments of Beenos, where you will see more entrepreneurial activity. Global Commerce is the most important segment for Beenos, due to the results of Buyee. FASBEE is a young business that focuses on helping Japanese fashion brands sell overseas. It is similar to Buyee, but focuses in on apparel. Groobee is a relatively new business in the Entertainment segment. It helps artists and celebrities quickly create an ecommerce site. Groobee leverages the shipping capabilities of Buyee in order to help artists sell abroad.

Beenos has multiple businesses that it is currently incubating. The company created Beenos Travel in 2019, which operates the ‘Travel Bar’ website as well as ‘Monthly Hotel’. Travel Bar is one of the largest sites in Taiwan for information regarding traveling to Japan. Monthly Hotel is a site that helps customers book long term reservations with hotels. Narabee is a mobile service that Beenos created to help sell goods at events like concerts. Beenos created Linkus in 2020, which is an online HR business that connects Japanese companies with foreign workers. In 2022, Beenos established BeenoStorm, which operates an e-sports team. Recently, Beenos announced a pay-as-you-go volumetric global logistics service, catering to small shipments.

There is a long list of startup businesses that Beenos formed internally. My reason for writing about this is to give a sense of the culture of Beenos. It really fits in with the quote below from Pabrai. You can tell it is part of their DNA to incubate new businesses. Experiments are being run, and the company is constantly searching for new ways to serve customers. While Buyee has been a successful entrepreneurial endeavor, it is too early to tell if Beenos will be a high quality spawner. We need to wait and see if any more startups gain traction in the marketplace. That will take time to verify. However, the important piece is that cash burn on startups has been low, and no business has required massive capital expenditures. As long as cash burn and capex requirements remain low, Beenos has time to let these experiments run their course. It allows for some room for failure, as they aren’t risking the company on one massive bet.

Beenos has managed to keep cash burn and capex spend low, and this is a little easier to see in 2023 now that Beenos has separated the venture capital portfolio from the internal startups in the ‘incubation’ business segment. In past years, gains on the sale of venture capital investments led to volatile results in this business segment. In 2023, Beenos reported an operating loss of ¥1 billion from new businesses. This is equivalent to less than $7 million in USD. To me, this is a low operating loss given how many new business ventures the company has going on. Beenos has reported a positive pretax operating profit for its ‘incubation’ business segment in 7 of the last 10 years. As I mentioned, the operating profit is due to the sale of investments from time to time. Beenos has generally had enough investment gains to offset any cash burn from startups. The last decade proves that Beenos has a focus on cost control, while balancing an entrepreneurial culture at the same time. This is an important piece of the spawner framework.

In terms of capex spend, we can just look at the balance sheet. Beenos has equity capital of ¥13 billion. ¥10.6 billion of this capital is in the form of cash, while the book value of its venture capital investments is ¥4 billion. This is a very liquid balance sheet. There is very little property, plant, and equipment at Beenos. Payables on the liability side exceed receivables, so there isn’t much required in terms of working capital. The entire company has little equity capital tied up, outside of cash and investments. This is interesting considering the fact that Buyee manages a complex international logistics operation. The firm is able to somehow work with third party warehouse operators to get the storage space they need, as opposed to building out and owning the real estate themselves.

As Pabrai pointed out in his lecture, spawning can be very tax efficient. Startup businesses typically lose money. The losses of a startup can offset some of the profits of an established firm, lowering the tax bill. In a way, the government acts as a benevolent venture capitalist partner in this sense. Losses from startup businesses create tax credits for corporations, which can be thought of as interest free loans from the government. The startup doesn’t have to start repaying the government in the form of taxes until it is profitable. Eventually, these losses have to turn into some sort of profitable business for the investment to be worth it. Losing money forever to avoid taxes is no way to get rich. Companies with a spawner DNA that eventually can create successful businesses from scratch just have a tax advantage over companies that acquire profitable businesses externally.

Capital Allocation Going Forward

Teruhide Sato, the founder of Beenos, is an entrepreneur at heart. I assume he is responsible for creating the culture that Beenos has now. Teruhide Sato stepped down as CEO of Beenos in late 2014 in order to focus on venture capital. This appears to be his passion. The large venture capital portfolio that Beenos has is from Teruhide Sato’s tenure. I haven’t noticed many major venture capital investments in recent years. My guess is that over the long run, we will see Beenos slowly liquidate its venture capital portfolio and focus its capital on internally formed startups as opposed to investing in outside companies. I would be pleased to see Beenos spend its creative energy on wholly owned businesses. The firm has bought back a little bit of stock in recent years as well. It is nice to see they have that in the toolkit. With that being said, shareholders should expect funds to mostly flow to entrepreneurial activities within the company.