Beenos is currently my largest holding, and it’s a company I’ve written about in the past. Beenos is an entrepreneurial company with a low valuation. Although these alone are nice features, over time I have been appreciating one of its subsidiaries more and more. This wholly owned subsidiary is called Buyee. I’ve also been impressed with the culture of Beenos.

I’m not going to write about how Beenos has ¥5.5 billion in net cash, along with a ¥21.7 billion venture capital investment portfolio, when the valuation of the entire company is just ¥17.5 billion. I’m not going to write about how the valuation looks cheap based on earning power alone, even if the venture capital portfolio turned out to be worthless. Instead, I want to drill down on Buyee, as well as the entrepreneurial culture of Beenos overall.

In this article, I am going to focus on Buyee as a middleman, and investigate the reasons why that can be a surprisingly good type of business. In a follow up article, I am going to focus on Beenos as a spawner of new businesses.

The Value of a Middleman

First, let me start out by going through some examples of valuable businesses that could be referred to as middlemen. Jay Vasantharajah opened my eyes to this in a presentation he gave that discussed Pool Corp (POOL). He also wrote about this topic briefly in his newsletter. At the end of the day, a middleman can create plenty of value if both customers and suppliers are highly fragmented.

The stock chart of POOL looks beautiful, and this is for a company that is a distributor of pool equipment. The picture below is a slide from one of POOL’s most recent investor presentations. POOL has over 125,000 customers who are retailers and contractors. On the other side of the equation, POOL has over 2,200 suppliers dealing with over 200,000 products. This is high fragmentation. POOL adds value by connecting all these retailers with all these different suppliers. Due to specialization, POOL can help make the supply chain more efficient. Although there might not be many barriers to entry for a distributor, scale is a competitive advantage for a business like POOL. The company benefits from network effects in terms of relationships, but also should be able to operate more efficiently due to economies of scale.

The New York Stock Exchange (NYSE) could be another example of a valuable middleman type business. Again in this example we have high fragmentation. There are thousands of stocks listed on the NYSE, with a huge number of individuals and organizations who want to buy or sell those stocks. It would be pretty inefficient if a seller had to go knock on doors in order to find a buyer. A stock exchange, like the NYSE, makes the entire environment more efficient and lowers the cost of buying and selling shares of stock. The larger the exchange, the more value provided. A larger exchange can offer more selection and can connect more potential buyers and sellers.

Buyee

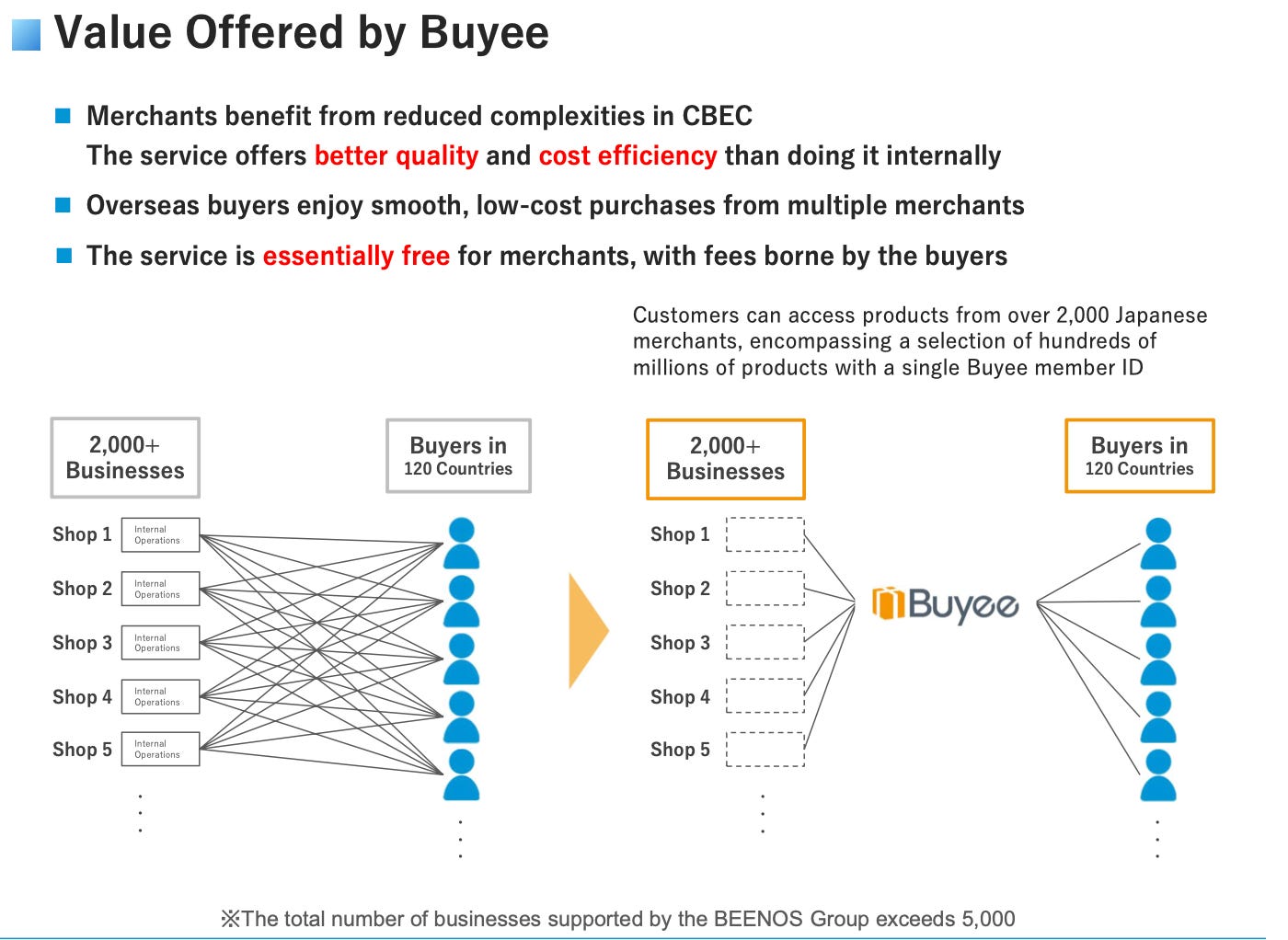

Buyee operates a proxy purchasing service. What does this mean? Basically, Buyee helps facilitate cross border ecommerce, enabling Japanese merchants to sell products abroad. Buyee has partnered with over 5,000 merchants, and Buyee’s website displays the products of those merchants. Partners of Buyee range from giant global marketplaces, down to small, local Japanese retailers.

It might be easier to explain Buyee by going through some examples and use cases. I’ll start with the giant, global marketplaces. These include eBay, Yahoo Japan, Rakuten, and Mercari. Yahoo Japan operates the leading auction site in Japan. The problem is that it’s basically only serving Japan. The company operated internationally at one point in time, but cut back presumably due to the costs and complexities involved with cross border ecommerce. Yahoo Japan decided to focus on its best market - Japan. Although eBay operates internationally in a major way, many individual merchants and individual products only allow for domestic shipping. This is where Buyee comes into play. Both Yahoo Japan and eBay have integrated into Buyee’s website. This means that the exact same pair of shoes might be for sale on both eBay’s website, as well as on Buyee’s website. If a consumer purchases these shoes on Buyee, then Buyee immediately purchases the shoes for you on eBay’s site. This is what is meant by proxy purchasing. Buyee will purchase products from eBay in America, send them to a Buyee warehouse located in the U.S., and then ship the product overseas. Similarly, Buyee has warehouses in Japan for dealing with partners like Yahoo Japan.

Another case study would be smaller, local retailers that partner with Buyee. One example of this type of partner is an online store called “10 mois”, which specializes in hand crafted products for infants. 10 mois can ship domestically within Japan. However, when I go to their website, Buyee is prominently displayed as an option for international shipping. A Buyee cart is integrated right on their website.

I can see why ecommerce companies want to partner with Buyee. The company doesn’t charge partner sites, they just charge the end consumer. This means that eBay, Yahoo Japan, and 10 mois all get access to new markets, customers, and additional revenue streams without any cost, complexity, or risk in terms of investment in inventory. The end consumer is someone who could not buy this product without a proxy purchasing service like Buyee. Their choice is to either pay a fee to someone like Buyee, or don’t buy the product at all. Buyee handles shipping, product translation, payment processing, and currency exchange for the end consumer. Buyee claims that their service is 30% cheaper than standard shipping from Japan to the U.S., which would mean value is being created for both consumers and merchants.

Despite not charging a fee to merchants, and despite offering a lower cost shipping option to consumers, Buyee operates with 30% pretax operating margins as shown below. The company takes a fee of about 16% per transaction, which ends up being accounted for as revenue for Buyee. After payment fees and warehouse costs, over 60% of revenue is left over as gross profit. This has been a consistently profitable business for Beenos for years now.

There is fragmentation on both sides of the market, as you can see in the picture below. This is the ideal set up for a middleman like Buyee. The business connects thousands of merchants with buyers in 120 countries. Thousands of merchants previously decided not to offer access to international consumers for one reason or another. Yet, international consumers demanded these products. Beenos saw a gap in the market and filled it, which is exactly what a good entrepreneur does.

Risks

There are a few different types of risks here. Competition could come from outside companies, or from partners who decide to manage cross border ecommerce internally. The biggest risk is from the outside, as there are low barriers to entry in the proxy purchasing business. International shipping and cross border transactions are complicated, but any firm with some knowledge or experience in the area could open up shop tomorrow. FromJapan and ZenMarket are two examples of companies competing with Buyee. This will be a threat for Buyee as they won’t ever be completely shielded from competition. However, a middleman benefits from size, and Buyee is currently the largest in its field in Japan. Scale could help drive down costs, and there are some benefits from network effects in terms of relationships. With that being said, this is a business in which constant execution is needed to stay on top.

Why wouldn’t partners just handle international operations themselves? In my mind, there is little incentive to do so. Partnering with Buyee lowers costs. Buyee doesn’t charge these merchants anything, while merchants don’t have to build out an efficient international logistics operation. If the end consumers were being ripped off and were paying too high of prices, then other proxy purchasing services would be sure to step in due to low barriers to entry. Buyee’s competitors would probably step in first and lower costs or improve service before merchant partners actually had to.

Conclusion

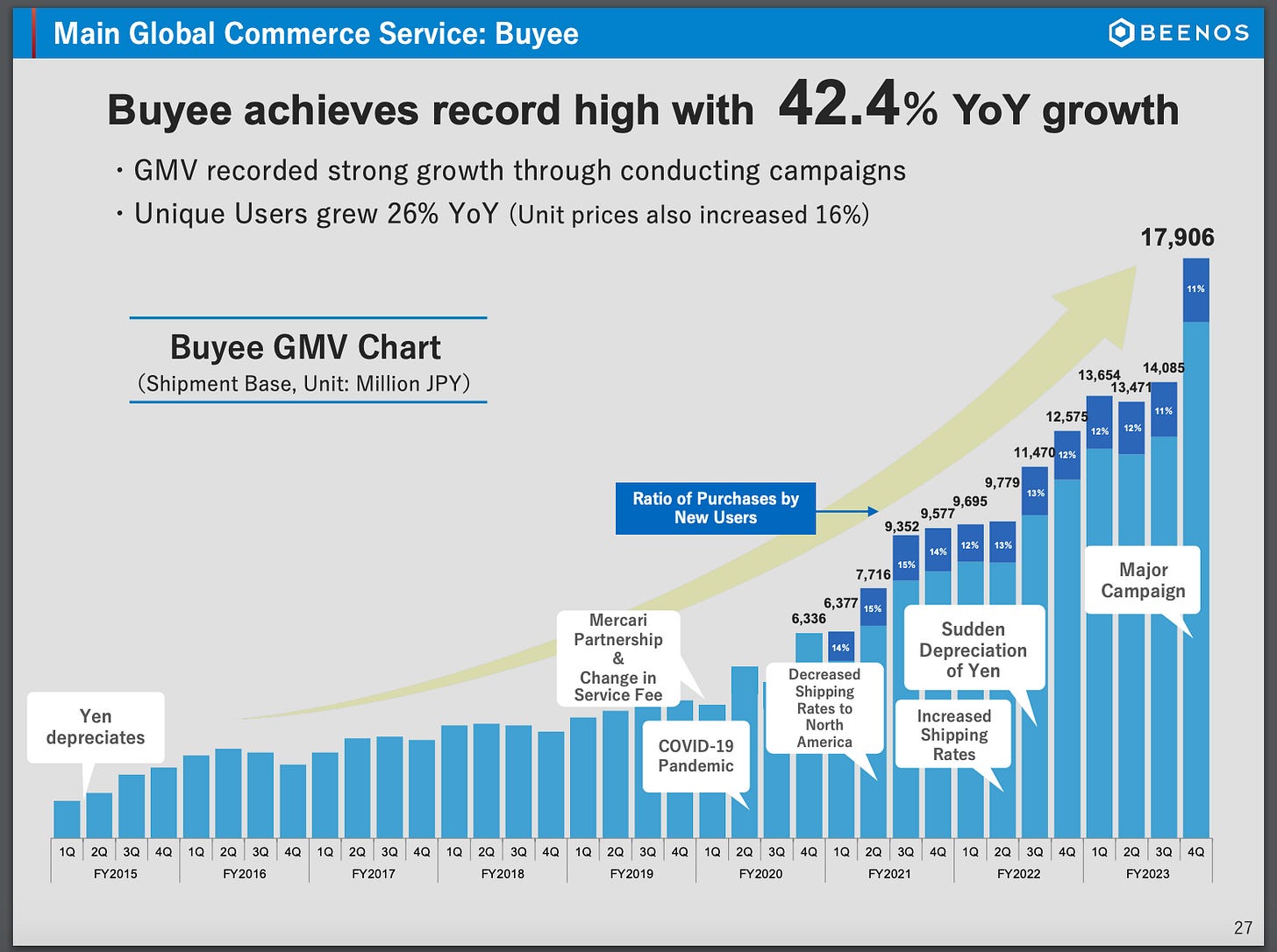

What has all this meant for Buyee so far? A big arrow up and to the right. The gross merchandise value (GMV) has compounded at a rate of 31% per year since 2015. The GMV figure represents the total value of transactions that take place on its platform. Revenue, disclosed for Buyee and a subsidiary called Tenso combined, has compounded by 22% per year since 2015 as well. Pretax operating profit for the ‘Global Commerce’ segment of Beenos, which includes Buyee, has compounded by 31% per year over that same period. Buyee makes up 85% of the ‘Global Commerce’ segment. It has been a nice run for Buyee over the last decade.

The real focus of Buyee has been helping Japanese merchants sell to foreign consumers. With warehouses all around and experience in cross border transactions, Buyee has an opportunity to be a leading proxy purchasing service for many other countries as well. If they can sell goods from Japan to Korea, then they should be in a good spot to sell goods from Korea to Japan, too. This should be the case for any given country, as long as Buyee can find a gap in the market where demand isn’t being properly served. A midterm goal for Buyee is to “create a cross border ecommerce model that does not go through Japan”. They have already formed partnerships with firms in countries like Korea. It will be interesting to see if Buyee can replicate its model elsewhere and continue its growth over time.